Over 5000 Financial Assets Available on Capital.com

No Professional or Investment Advice. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation.

Capital.com Review

If you’re someone who is interested in online trading, make sure you research deeply all about a broker. This is important because eventually, you’ll add money to the account. You need to find a broker with whom your money is safe. We shall see what Capital.com offers, and if it is a good choice.

Capital.com is a CFD broker that started its operation in 2016. It’s located in Europe. Its offices spread across Europe, the UK, Middle East, and Australia. This broker is widely used among traders and is ranked as the fastest-growing company in the Middle East by the 2024 Deloitte Technology Fast 50. There are over 3000 financial assets available, which is an impressive number. This award-winning broker from leading industry authorities – like ‘Best Overall Trading Platform’ (Online Money Awards 2024) and ‘Best Trading App 2023’ (Good Money Guide), is really promising.

Capital.com Pros and Conss

- Regulated broker

- Over 6000 financial assets are available

- Award-winning broker

- Fast account opening

- CFD only trading

- Inactivity fee

Is Capital.com Secure?

Capital.com is regulated globally by several authorities including: ASIC, FCA, CySEC, SCB, CMA, FSCA and complies with MiFID directive. This means that Capita.com is a safe place to trade.

Markets and Products

As mentioned, Capital.com provides access to over 5,000 markets. You can trade:

- Shares

- Indices

- Cryptocurrencies

- Forex

- Commodities

The spreads and leverage depend on the asset you choose.

Capital.com Fees and Charges

There are no withdrawal and deposit fees. However, there’s a $10 inactivity fee if you’re inactive for more than a year. Also, Capital.com doesn’t charge any commissions.

Capital.com Account Types & Account Opening

Capital.com is focusing primarily on CFD trading.For 2026, it offers two basic account categories (Retail and Professional), which are further divided into sub-types depending on the investor’s needs and location.

You can also create a Demo account. So you get to check out the platform before you decide to open a live account.

How to Open an Account

To open an account follow these steps:

- Go to the website

- Click the “Sign up” button

- Enter the needed information

- Click “Continue” Sign up via email or social login.

- Verify your identity with an official document and proof of address.

- Complete a suitability questionnaire.

- Make a deposit

- You can practise on a demo trading account before trading for real

Trading Platforms

Capital.com provides four main platforms:

- Mobile app

- Web platform

- Trading View

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

Mobile app

Capital.com has a dedicated mobile app that suits all traders. There are many advantages of the mobile apps you will see. You can download it on both iPhone and Android devices on the app store. If you’re lazy searching for it, you can scan the QR code on the website.

Web Trading Platform

The platform combines an intuitive user interface with sophisticated analytical tools, real-time financial reporting, and customizable watchlists

Trading View

Capital.com offers TradingView you can download on Windows, Linux, and macOS.The same TradingView platform can be used on your browser without the need to download anything. The choice is yours.

Meta trader

Capital.com supports MT4 and MT5 for advanced trading and experienced users.

Capital.com Research Tools

There’s only one research tool available is the CFD calculator. With it, you can calculate your hypothetical profits and losses without charge.

Capital.com Educational Content

The Educational content is probably one of the best you’ll see. The Education hub covers all skill levels, from beginner to expert. You can literally start out as a newbie, get all the knowledge you need at Capital.com, and become a serious trader. There are guides, quizzes, videos, whatever you can think of.

Customer Service Overview

Many users love Capital.com customer support. If you need to contact the customer support for whatever reason, you can do it via:

- Live Chat: Available directly on the Capital.com platform, as well as via WhatsApp, Facebook Messenger, Telegram, and Viber

- Phone: International: +44 2080893577, EU (Cyprus): +357 25123646, UAE: +971 4 576 8641

- And email: [email protected]

Capital.com Deposit and Withdrawals

There are around 20 depositing options you can use to add funds to your account. They include e-wallets, Bank cards, Online baking transfers, and wire transfers. The deposit options depend on the trader’s location. There are some methods specific to a region or country. Deposits take up to 3 business days. The minimum amount you can deposit is typically $20/€20/£20. For wire transfers, the minimum is higher, usually $50/€50/£50

Withdrawal Methods and Payout Times

Withdrawal methods are as variable as deposit methods. They usually take more time than deposits. So the withdrawal methods take from 24 hours to up to 5 business days. Capital.com processes the withdrawal requests in less than 24 hours, but different options have different time windows.

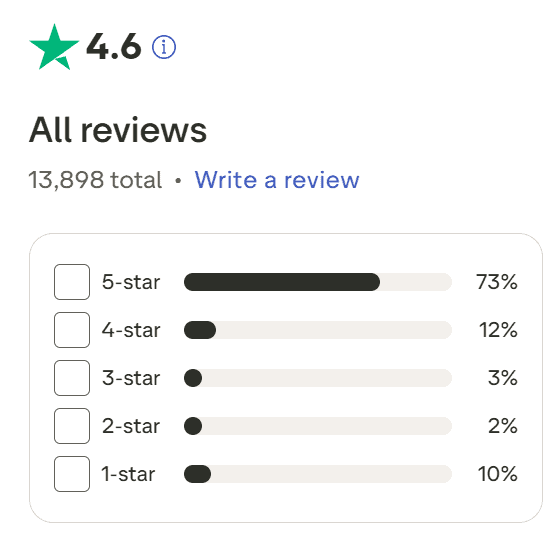

Capital.com Online User Reviews and Ratings

Capital.com has a 4.6 star rating on Trustpilot, out of over 14k reviews! And not only that, 73% of the reviews are 5 stars. Users agree that this is a great place for beginners AND experts. Besides that, the customer service seems to be on point. There are 10% of 1 star reviews. Some users have difficulties to deposit funds, and some have issues with the platform.

Author Opinion on Capital.com

Capital.com is a modern CFD broker for most types of traders. It appears that it is the strongest fit for newer traders who want to learn because of its educational content. The low minimum deposit also makes it beginner friendly. However it significantly boosts its platform’s capabilities for veteran traders as well by offering seamless integration with MetaTrader 4 and TradingView for advanced charting and algorithmic trading.

Capital.com focuses only on CFD trading, which might be a no-no for some. It doesn’t seem suitable for long-term investors. But overall, this is a great CFD broker that is worth trying. It is not all bad things. There are over 5000 trading instruments offered. It’s a regulated broker, meaning it’s safe to trade on. And, there are no commissions or fees on deposits and withdrawals! If you don’t mind the CFD-only trading, Capital.com is a perfect fit for you.

FAQ

Yes, you can. It’s regulated by several authorities.

It’s $20.

From 24 hours to up to 5 business days.

Capital.com doesn’t take any commission.