Up to 1:500 Leverage

WE DO NOT RECOMMEND THIS BROKER. No Professional or Investment Advice. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation.

First Prudential Markets Review

First Prudential Markets is an Australian CFD and forex broker that caters to both beginners and experienced traders. Opening an account is quick and simple and you will find access to excellent educational tools, such as demo accounts and e-books.

First Prudential Markets Discount Codes Details:

At the moment, First Prudential Markets does not offer any discounts or promo codes.

- Regulated by top-tier bodies like the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC) in Europe, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Financial Services Authority (FSA) in Seychelles.

- Ultra-competitive spreads via the commission-based Raw ECN account.

- Best in Class honors in the MetaTrader and Best Zero Spread Forex Brokers categories in 2024.

- Access to the Iress platform with a wide range of tradable symbols.

- The mobile app lacks some features found in the best mobile trading apps.

- Educational content could be stronger.

- The Iress platform is more share-focused, and data fees can add up quickly.

- Not suitable for complete beginners

- Limited educational resources

- No cryptocurrency market

- No access to a maker fee rebate

Is First Prudential Markets Secure?

Yes, FP Markets is secure. It prioritizes security and regulatory compliance, regulated by ASIC, CySEC, FSCA, and FSA. It also segregates retail client funds into separate trust accounts, as required by ASIC, enhancing client security.

FP Markets employs robust measures to prevent fraud, including encryption protocols and continuous monitoring of suspicious activities. It has received 40+ global industry awards.

Awards include “Most Satisfied Traders,” “Best Trade Execution,” and “Best Customer Service.”

Markets and Products

FP Markets offers a diverse range of tradable instruments across global financial markets. You can trade:

- Over 60 forex currency pairs, including major, minor, and exotic pairs.

- Shares

- Metals like gold and silver.

- Indices

- Commodities such as oil, natural gas, and agricultural products.

- Bonds

- Cryptocurrencies like Bitcoin, Ethereum, and more.

First Prudential Markets Fees and Charges

FP Markets charges among the lowest trading commission fees in the industry. Here are some key fees and charges:

- Equity CFDs: Commission per side varies by exchange. For example, in Australia, it’s 0.06% with a minimum charge of 6 AUD, while in Singapore it’s 0.15% with a minimum charge of 25 SGD. No GST is applicable on CFD transactions.

- For international futures CFDs, the commission per side for products like SFE ASX SPI200, EUREX DAX, and CME E-MINI S&P500 ranges from 15 AUD to 17.5 USD1.

- FX commissions are built into the spread, meaning no separate charges. The same applies to metals, commodities, and indices.

- Platform fees depend on the trading platform you choose. MT4, MT5, and Iress Mobile are free to use, while Iress Trader / ViewPoint has a $60 monthly fee.

First Prudential Markets Account Types & Account Opening

FP Markets offers several account types.

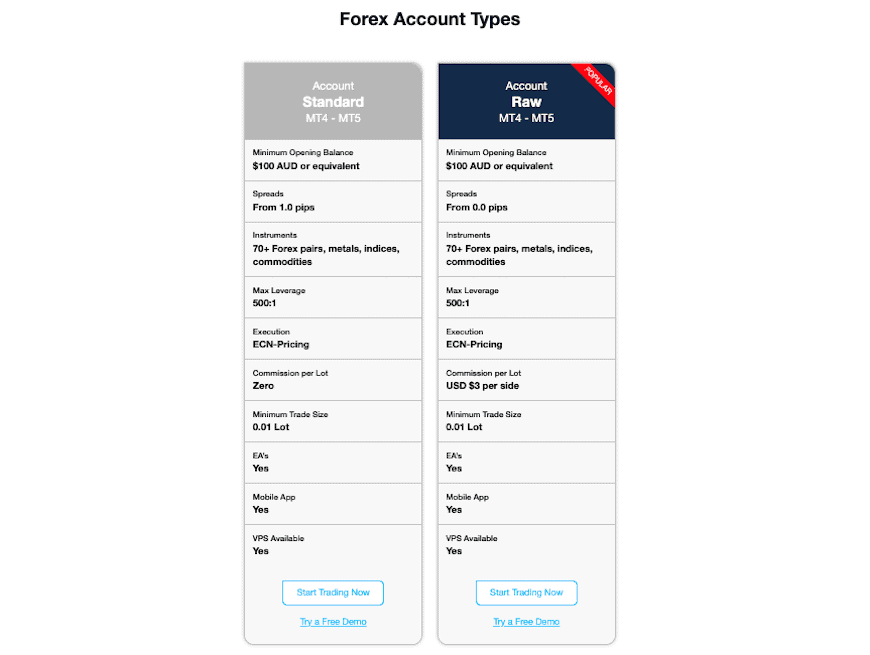

Standard Accounts: These are suitable for most traders. You can enjoy competitive spreads, low commissions, and a leverage of up to 500:1. A minimum deposit of AUD100 is needed.

Raw Accounts: A commission of 3$ USD per side is charged. Spreads start from as low as 0.0 pips and a minimum deposit of AUD100 is required. It also attracts a leverage of up to 500:1

IRESS Accounts: Designed for experienced traders. Offers superior trading conditions.

Islamic Accounts (Swap-Free): Complies with Islamic finance principles and includes no overnight interest (swap) charges.

Risk-Free Demo Accounts: Ideal for practice and learning and you can trade with virtual funds to develop your skills.

How to Open an Account

Opening an account with FP Markets is straightforward:

- Visit the FP Markets website and click on the account registration section.

- Enter your name, email address, and country of residence.

- Provide information, including your date of birth, address, and occupation.

- Select the account type that suits your needs (e.g., Standard, Professional, Islamic).

- Choose your base currency (USD, EUR, AUD, etc.).

- Decide on the trading platform (MetaTrader 4, MetaTrader 5, or Iress).

- Answer a brief questionnaire to demonstrate your understanding of financial products.

Remember that FP Markets requires identity and residency verification documents. The minimum deposit is $100, and the entire process can be done online within a day

Trading Platforms

FP Markets offers a range of advanced trading platforms to suit different trading styles and preferences:

Iress Essential

Iress Essential is a proprietary trading toolbox designed for global and multi-asset trading. It comes with an intuitive interface, time-efficient navigation, and compatibility with PC and Mac OS devices.

Mobile Trading Platform

With FP Markets’ mobile trading apps for Android and iOS devices, you can conveniently access the markets while on the go. These apps are designed with a user-friendly interface and robust functionality, allowing you to easily manage your account and execute trades from your smartphones or tablets.

Web Trading Platform

You have the option to use FP Markets’ web-based trading platform on any web browser without having to install anything. This platform is flexible and easy to access and comes with all the necessary trading features and tools to make trading a breeze.

Desktop Trading Platform

You can use its trading software on both Windows and Mac operating systems. Windows users can download the desktop platform, while Mac users can use web-based solutions. The software includes advanced charting tools and user-friendly interfaces. You can also use MetaTrader, algo-trading, and copy trading, catering to traders of all levels.

First Prudential Markets Research Tools

FP Markets has various technical analysis resources you can use to refine your trading strategies

First Prudential Markets Educational Content

FP Markets provides educational resources like:

- Webinars and seminars covering technical analysis, fundamental analysis, risk management, and trading strategies.

- Video tutorials on its website and YouTube channel.

- Ebooks and guides on forex basics, advanced trading techniques, and risk management.

- Market analysis and insights including daily market analysis, economic calendars, and trading insights.

Customer Service Overview

You can contact FP Markets customer support on their 24/5 Live Chat and email at supportteam@fpmarkets.com. The live chat operates during market hours, Monday to Friday. The support is also offered in multiple languages, catering to a diverse global clientele. You can also contact them via phone at +44 28 2544 7780 and +44 28 2544 7780

First Prudential Markets Deposit and Withdrawals

FP Markets has a flexible payment process for you to deposit funds and withdraw from your account. FP Markets does not charge internal fees for deposits or withdrawals. However, overseas bank transfers may incur intermediary fees independent of FP Markets.

Deposit Methods

You can deposit using:

- Credit cards (Visa, Mastercard)

- Debit cards

- Payment wallets (Neteller, Skrill)

- Poli Pay

- Online banking

- Bank wire transfer

Withdrawal Methods and Payout Times

Your withdrawal time depends on the method you choose. To withdraw funds, log into the Secure Client Portal and withdraw. You can withdraw using credit/debit cards, bank wire transfers, and more. The withdrawal amount must match your initial deposit and you must use the same method.

First Prudential Markets Online User Reviews and Ratings

FP Markets has a high rating of 4.8 out of 6,506 reviews.

- 94% give it a 5-star rating praising the platform for fast withdrawals and swift customer support.

- 2% give it a 1-star rating citing no payouts and account blockings.

Author Opinion on First Prudential Markets

FP Markets is a great choice for traders of all levels. It stands out with its simple and advanced trading platforms, wide variety of tradable instruments, and comprehensive educational resources. The broker’s customer service is quick to respond, and its deposit and withdrawal options are both flexible and secure. However, as with any financial decision, it’s essential to conduct your due diligence before opening an account with the broker.

Frequently Asked Questions

You can’t trust FP Markets 100% because it is licensed or regulated by top-tier regulators.

The minimum deposit at FP Markets is 100 AUD.

Withdrawals range from instant to 5 business days depending on the withdrawal method you use.

Brokers such as IC Markets and Pepperstone are a great alternative for Forex and CFD brokers.

Commission per side varies by exchange (e.g., Australia, Singapore, London). For example, in Australia, it’s 0.06% with a minimum charge of 6 AUD. International Futures attract a commission per side for products like SFE ASX SPI200, EUREX DAX, and CME E-MINI S&P500 ranging from 15 AUD to 17.5 USD. FX commissions are built into the spread, so there’s no separate charge. The same applies to metals, commodities, and indices.