Forex.com and OANDA are two well-known online forex brokers, offering exceptional trading services. Our in-depth comparison of both will analyze important factors that make both stand out, including security, regulation, accessibility, trading fees, trading platforms, and educational resources to help you select the right broker.

Comparison Overview

| Overview | Forex.com | Oanda |

|---|---|---|

| Year Established | 2001 | 1996 |

| Headquarters | United States | British Virgin Islands |

| Jurisdiction | ||

| Regulators | ASIC, CFTC, CIMA, CySEC, FCA, FSA, IIROC, NFA | ASIC, BVIFSC, CFTC, FCA, FSA, IIROC, MAS, MFSA |

| Trading platforms | MT4, MT5, Proprietary Platform | MT4, Proprietary Platform |

| Minimum Deposit | $100 | $0 |

| Minimum Raw Spreads | 0.0 pips | 0.0 pips |

| Minimum Standard Spreads | 0.8 pips | 0.6 pips |

| Minimum Commission for Forex | $5 per $100K | $5.00 per round lot |

| Islamic Account | Yes | Yes |

| Trust Pilot Rating | 4.7 | 4.0 |

Forex.com

Forex.com is an international forex and CFD broker that provides trading services across various financial markets, such as currencies, commodities, indices, and cryptocurrencies. It belongs to StoneX Group Inc., a renowned Fortune 100 financial services organization.

- Regulation by multiple financial authorities, including the CFTC in the USA, the FCA in the UK, and ASIC in Australia, providing a high level of trust and security.

- Variety of trading platforms, including its proprietary Advanced Trading Platform, MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

- Access to a wide range of markets, including forex, indices, commodities, and cryptocurrencies.

- Extensive research and educational resources, including daily market analysis, webinars, and trading guides.

- Competitive pricing and reliable trade execution.

- Higher fees compared to other brokers, particularly for smaller trades.

- Complex interface for beginners

Oanda

OANDA is a well-known online forex and CFD broker that provides trading services for currencies, commodities, indices, and bonds. With its reputation for transparency and competitive pricing, OANDA serves both retail and institutional traders.

- Regulated by multiple authorities, including the CFTC in the USA, the FCA in the UK, and ASIC in Australia.

- Offers user-friendly platforms, including its proprietary OANDA Trade platform and MT4.

- Known for transparent and competitive pricing, with no minimum deposit requirements.

- Provides various account types and customizable trading options.

- Includes research tools, market analysis, economic indicators, and educational resources.

- Limited in its range of markets compared to Forex.com.

- Customer support can be slow at times.

Forex.com vs Oanda

There are several similarities and differences between tForex.com and Oanda. Let’s take a look at them.

Regulation

Both FOREX.com and Oanda are considered safe for trading. They are regulated by top global financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC).

Forex.com is also registered Futures Commission Merchant (FCM) and Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC) and member of the National Futures Association.

Security

Oanda protects its customers from unauthorized access using 2-factor authentication (2FA). They also include comprehensive security coverage to ensure data is kept secure and private such as round-the-clock monitoring by a security operations center.

Forex.com separates customer deposits from its operating funds and uses real-time monitoring of the accounts to quickly detect and respond to potential security threats. It also employs Secure Socket Layer (SSL) encryption and 2FA to ensure that sensitive information, such as personal details and financial transactions, is kept secure from unauthorized access.

Market Range

Both brokers offer a wide range of markets including Forex pairs, indices, commodities, shares, and cryptocurrency. However, Forex.com takes the lead in the total number of assets with over 4500 assets, while Oanda only has around 120. Another key difference is in the assets offered by each. Forex.com includes ETFs and a larger selection of shares, whereas OANDA includes bonds and metals.

User Interface

Oanda is generally more user-friendly and easier to navigate, making it a good choice for beginners. The interface is clean and intuitive, with customizable features that cater to both novice and experienced traders.

On the other hand, Forex.com offers more advanced features and tools, beneficial for experienced traders but may be overwhelming for beginners. The learning curve is steeper due to the extensive functionalities available.

When it comes to mobile experience, Oanda’s mobile app is praised for its ease of use and functionality, making it suitable for traders who prefer to trade on the go while Forex.com though feature-rich is complex for beginners.

Account options

Both brokers offer a variety of accounts. Oanda has a straightforward range of accounts, including standard, premium, and core accounts while Forex.com includes a wider variety of account types, including standard, commission, and STP Pro accounts, catering to different trading preferences and strategies.

Minimum Deposit

Oanda has no minimum deposit requirement for standard accounts, making it accessible for those with limited capital. Forex.com’s Standard account requires a minimum deposit of $100, which is still relatively low but higher than OANDA’s no minimum requirement.

Trading Fees

Oanda includes overnight rates for positions held overnight. These rates vary depending on the currency pair and market conditions. Swap rates can be checked on the OANDA platform. Inactive accounts (for 12 months) are charged an inactivity fee of $10 per month if there are no trading activities for 12 months. The broker doesn’t include any deposit fees or withdrawal fees.

Forex.com also charges for positions held overnight as well as an inactivity fee of $15 per month if there is no trading activity for 12 months. The broker also doesn’t charge fees on deposits or withdrawals.

Spreads and Commissions

Oanda offers variable spreads with the option for lower spreads through premium and core accounts, with a commission per trade. The Core Account attracts a commission of around $5 per 100,000 units traded (both ways), in addition to the lower spreads.

At Forex.com the Standard Account has No commissions on trades and the costs are included in the spread. The Commission Account attracts a commission of around $5 per 100,000 units traded (both ways), while commissions vary for the STP Pro Account but are typically competitive and lower per unit traded due to the high volume.

Leverage

Both brokers’ leverage options are similar, up to 50:1 in the US, with potentially higher leverage available in other regions subject to regulatory limits.

Trading Platforms

Both OANDA and Forex.com offer multiple trading platforms, each with its own features and functionalities.

Forex.com: The broker offers Advanced Trading Platform (Web and Mobile), MetaTrader 4 (MT4), MetaTrader 5 (MT5), and NinjaTrader.

Oanda: The broker includes Onda Trade (Web and Mobile), its propriety platform, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a TradingView Integration.

If you prioritize ease of use and an intuitive interface or are a beginner, Oanda is a better option. Forex. com is better for advanced traders looking for a wider variety of platforms and advanced trading tools.

Educational and Research Content

At Oanda, you will find webinars, events, market analysis, news, articles, and an economic calendar. The educational resources are structured and well-organized and the OANDA Academy is a strong resource for traders of all levels.

Forex.com has a wider variety of educational content, including detailed courses, extensive webinars, and in-depth market analysis. Its educational resources are comprehensive and cater to traders seeking detailed information and insights.

Customer Service

Both Oanda and Forex.com offer customer service 24/5, which you can access via live chat, phone, or email. You can also find help using the FAQs, articles, and guides on various topics. However, Oanda’s customer support takes a bit longer to respond, especially on email.

User Reviews and Ratings

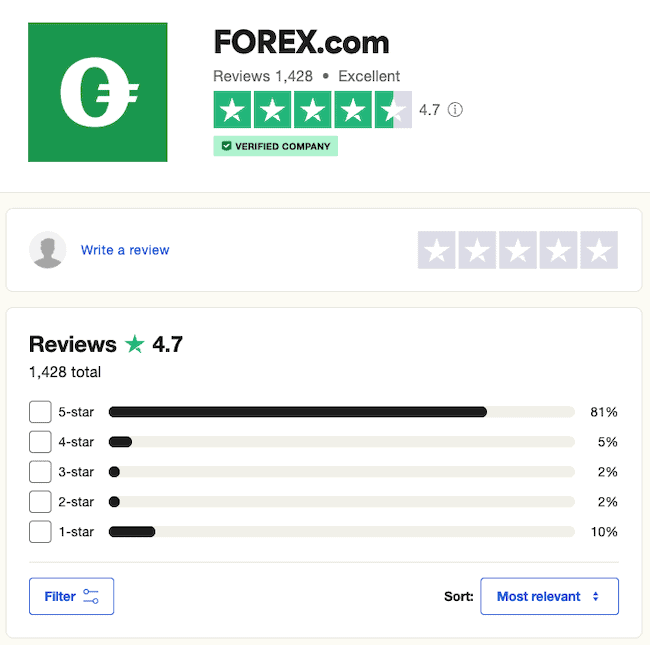

Forex.com has a Trust Pilot rating of 4.7, with 81% out of the 1,397 reviewers giving it 5 stars for its responsive customer support and trading platform.

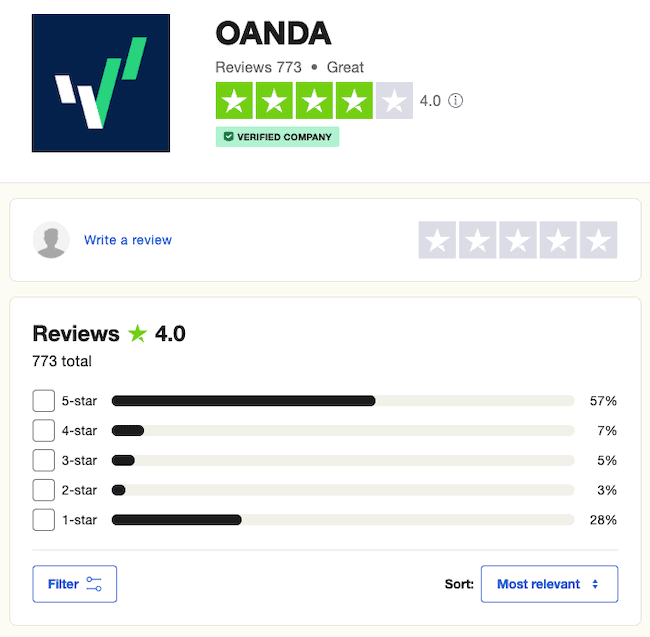

On the other hand, Oanda has a rating of 4, with 56% of the 755 reviewers praising it for its trading fees and trading platform.

Conclusion

Both Oanda and Forex.com offer different value. If you are looking for a broker with a wide range of markets, extensive research, and educational resources, and are comfortable with potentially higher fees choose Forex.com. If you prefer a user-friendly platform, transparent and competitive pricing, and flexible account options, especially if you’re a beginner or prefer trading primarily forex pairs, Oanda is the better option for you.