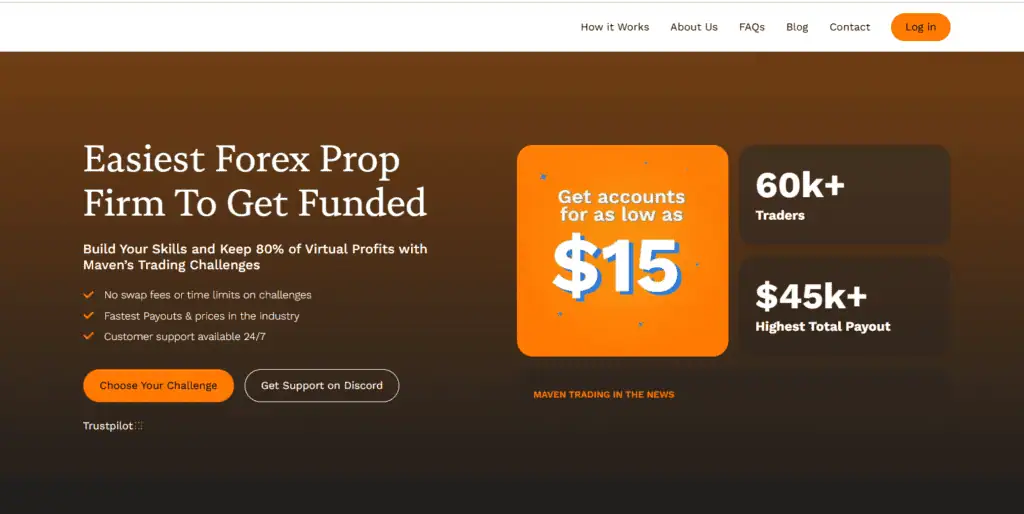

Easiest Forex Prop Firm To Get Funded

No Professional or Investment Advice. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation.

Maven Trading Review

Maven Trading is a proprietary trading firm that offers simulated trading challenges for aspiring traders. With various evaluation models and a focus on flexibility, it is a great option for novice and experienced traders.

Coupon Code

Maven Trading doesn’t have an active coupon code, but that doesn’t mean they won’t have any in the future!

Pros and cons

- Decent profit split

- No minimum or maximum trading days required

- Scaling plan up to $1M

- Spreads a bit high

- Limited transparency regarding liquidity providers

About Maven Trading: An Overview

Maven Trading, like most companies, helps traders unlock their full potential. They claim that you can expect from them confidence and trust, market-leading fees, and charted territory.

Company Name, Owner, Founding and Address Details

Maven Trading operates under the name Mavsoftware LTD, which is the official company behind the prop firm. It handles the business and legal side of things.

Chris Hunter is the CEO of Maven Trading. He’s the one steering the ship, focused on building a platform that supports and empowers traders.

Maven Trading got its start in 2022, making it one of the newer players in the prop trading world, though it’s already gained a lot of traction.

Address: 167-169 Great Portland Street, 5th Floor, London, W1W 5PF, England. The company is based in London, right in the heart of the city, giving it a solid presence in a well-known business area.

Trading Platforms

At Maven Trading, you can use cTrader and Match Trader platforms.

Instruments Available

Commodities

| ALUMINIUM | BRENT | COCOA | COFFEE |

| COPPER | CORN | COTTON | NGAS |

| SOYBEAN | SUGAR | WHEAT | WTI |

| XAGUSD | XAUUSD | XPDUSD | ZINC |

| XPTUSD |

Digital ETF’s

| BTCEUR | BTCUSD | ETHBTC | ETHUSD |

FX

| AUDCAD | AUDCHF | AUDJPY | AUDNZD |

| AUDUSD | CADCHF | CADJPY | EURNZD |

| EURPLN | EURSEK | EURTRY | EURUSD |

| GBPAUD | GBPCAD | GBPCHF | GBPJPY |

| GBPNZD | GBPUSD | NZDCAD | NZDCHF |

| NZDJPY | NZDUSD | USDCAD | USDCHF |

| USDENH | USDHKD | USDJPY | USDMXN |

| USDPLN | USDSEK | USDSGD | USDTRY |

| USDZAR |

Indices

| AUS200 | CHNIND | EU50 | FRA40 |

| GER30 | HKIND | ITA40 | JAP225 |

| SPA35 | SUI20 | UK100 | US100 |

| US2000 | US30 | US500 |

How to Make Payments

Maven Trading offers two payment methods: crypto and direct bank transfer. The bank transfer option is country-dependent. There is not much information provided regarding the fee structures of these payment methods.

Account Sizes Available

At Maven Trading, you can enjoy six different account sizes:

- $2k

- $5k

- $10k

- $20k

- $50k

- $100k

You also have an option to extend them up to $400k for certain programs.

Profit Splits in and Targets

You get to keep 80% of the profits. Maven Trading keeps the remaining 20%.

The three step challenge has a profit target of 3% in all steps. The two step challenge has a 8% and 5% profit target, and the one step challenge has a profit target of 8%.

Maximum Daily Drawdown and Loss

You can lose up to 3% daily in the three step challenges, and 8% in the two step challenges. The one step challenge has a 5% from your highest equity trailing drawdown. When it comes to daily drawdown limits, it’s 2% for the three step challenges, 4% for the two step challenges, and 3$ and the one step challenge.

Minimum/Maximum Trading Days Required

You’re not limited when it comes to trading days.

Rules and Challenges

With most prop firms, including Maven Trading, you’ll need to pass a challenge before you can trade with real (simulated) capital. The idea is to show that you can trade profitably while managing risk. At Maven, they offer a few different challenge types—1-Step, 2-Step, and even a 3-Step model. The profit targets vary depending on which one you choose, but usually range from 3% to 8%. While you’re working through the challenge, you’ll need to stick to some key rules, like not losing more than 3% in a day or 5–8% overall. One thing traders like about Maven is that there’s no minimum or maximum number of trading days, so you can take your time or pass quickly if you’re confident. As long as you stay within the rules and hit the target, you’re good to go. After that, you move on to a funded account where the real payouts start coming in.

Steps Available

There are three types of challenges available:

- One-step challenge

- Two-step challenge

- Three-step challenge

Pricing Challenge

| Account Size | One Step Challenge Price | Two Step challengePrice | Three Step challengePrice |

|---|---|---|---|

| $2k | $15 | $19 | $13 |

| $5k | $19 | $22 | $17 |

| $10k | $37 | $44 | $38 |

| $20k | $68 | $88 | $76 |

| $50k | $170 | $220 | $190 |

| $100k | $380 | $440 | $299 |

Commissions and Fees

Maven Trading didn’t mention any specific commission structures. Traders should be aware of potential wider spreads on certain instruments.

Refund Policies

Maven Trading offers a refund of the evaluation fee upon successful completion of the challenge and transition to a funded account.

Trial Offers

There are no trial offers at Maven Trading.

Payout Schedules

Payouts are processed every 14 days, offering a bi-weekly payment schedule.

Contact

The main way to contact Maven Trading is to open a ticket via Discord. Besides that, you can also chat with them on the website.

Maven Trading FAQ Section

Traders can have up to $200,000 in starting capital across funded accounts. Additionally, Maven offers a scaling program that allows traders to grow their accounts up to $1,000,000 based on consistent performance.

Maven Trading does not currently offer free retries for failed challenges. However, they provide a “buyback” feature, allowing traders to regain access to a funded account by paying 60% of the drawdown amount without retaking the challenge.

Violating trading rules, such as exceeding drawdown limits, and engaging in prohibited trading strategies like copy trading or high-frequency trading can result in account termination. Maven enforces these rules strictly to maintain a fair trading environment.

Yes, accounts that remain inactive for five consecutive trading days may be subject to deactivation.

Absolutely. Traders who achieve a 10% profit over four months (averaging 2.5% per month) and process at least one payout per month are eligible for a 25% increase in their account size. This scaling can continue until reaching a maximum account size of $1,000,000.