Arrived: Earn rental income, grow your equity, and diversify your portfolio effortlessly.

No Professional or Investment Advice. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation.

Arrived Review

Have you looked into real estate investing? You might have seen Arrived Homes. Arrived, formerly known as Arrived homes, is a new way to invest in real estate. you can own your very own part of properties with a little money.

Arrived is founded in 2019 in the US. It was created to democratize real estate investments by lowering barriers like large down payments, property management hassles, and the need for knowledge to invest in real estate.

Arrived Pros and Cons

- Minimum investment of $100

- Offers liquidity

- Easy to use

- Regulated and transparent

- Tax advantage

- Good for beginners

- High Fees

- Low liquidity for individual investments

How To Register at Arrived

Registering to the Arrived site is very easy:

- Click the “Sign up” button in the upper right corner

- Enter the email and password

- Click “Continue”

How Does Arrived Work?

Arrived simplifies real estate investment. It makes it affordable for investors with a few hundred dollars. As an investor, you can enter the market without needing a full down payment. This way lowers the risks.

The earnings come from:

Dividends: Quarterly rental income distributions.

Appreciation: Gains realized when the property is sold after the holding period.

Arrived Fees

Fees are different for different types of investments.

| Type of Rentals | Sourcing Fee | Assets Under Management (AUM) Fee |

| Long term Rentals | 3.5% of property purchase price | 0.15% of the property purchase price (quarterly) |

| Type of Rentals | Sourcing Fee | Gross Rents Fee |

| Vacation Rentals | 5% property purchase price | 5% of gross revenue |

| Type of Rentals | Quarterly Asset Management Fee | Sourcing Fee |

| Arrived Single Family Residential Fund | 0.25% | 3.5% of the total purchase price of newly added property of the fund |

Property Management

| Long-Term Rentals | 8% of gross rental income | |

| Vacation Rentals | 15% to 25% depending on the market, specified on each property page. | |

| Miscellaneous | May also charge one-time expenses for lease-ups, renewals, or rehab and turn support |

Arrived Transparency

Arrived is absolutely transparent regarding liquidity, fees, and reporting. The investors usually hold shares of 5-6 years for single family homes. For vacation rentals, it’s 5-15 years. All the fees Arrived has, are shown.

Understanding Liquidity at Arrived

The Arrived liquidity depends on the investment type. So a single family residential fund provides more flexibility than individual vacation homes. Redemptions within the first five years incur fees:

- First 6 months – No redemptions (lockout period)

- 6 months–1 year – 2% fee

- 1–5 years – 1% fee

- Over 5 years – No fee

Investment Selection

Arrived presents three investment paths: homes, vacation properties, or their residential fund. Customers can select direct property investments or join the fund, which Arrived operates as a REIT. The platform focuses on residential holdings.

Investing through Arrived means purchasing LLC shares tied to properties. Your share count establishes your stake, generating returns from both rent payments and property appreciation.

Educational Content at Arrived

Arrived matches peers in investor education through its knowledge base. The platform maintains a blog covering:

- Real estate fundamentals

- Platform usage guidelines

- Market analysis

- Vacation property insights

- Tax considerations

Arrived Customer Support

So far, there are a few ways to contact Arrived.

- Email: support@arrived.com

- The social media accounts

They could definitely have more contact options in the future.

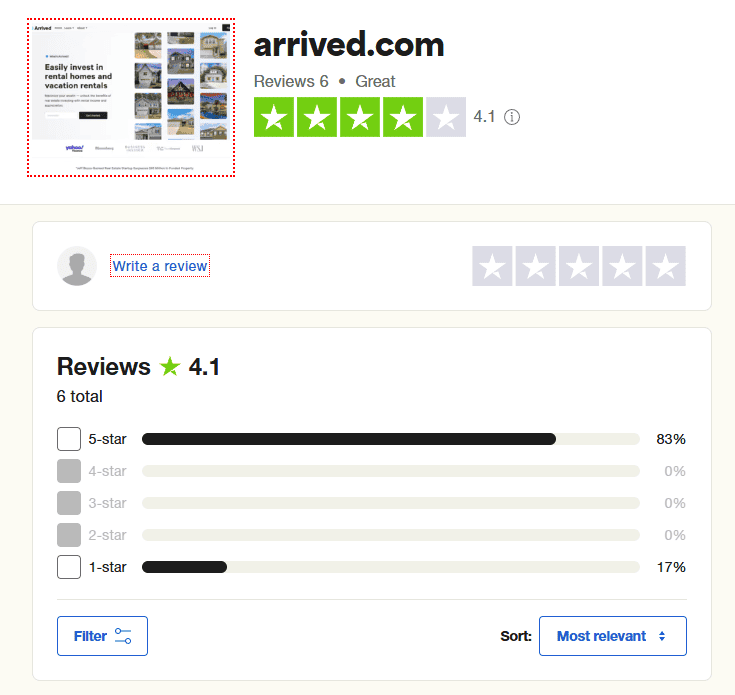

Arrived Online User Reviews and Ratings

There are only 6 reviews on TrustPilot for Arrived. Only one of them is 1-star and the remaining five are 5 star reviews. Unfortunately, there are not enough reviews which you can use to check if Arrived is worth trying or not.

Author Opinion on Arrived

With Arrived, you have the opportunity to invest with only $100. While individual properties require investors to hold their shares for 5–15 years, limiting liquidity, the Arrived Fund (a REIT) offers more flexibility with a six-month holding period and lower early redemption fees compared to other companies.

Arrived has a strong process for selecting properties, ongoing monitoring, and reporting on performance. With backing from top investors and a track record of solid returns, Arrived offers a great option for those looking to build wealth in real estate with a low investment threshold.

FAQ

Yes, it is.

No, Arrived itself is not a REIT. But, it offers a REIT-like investment option.

No, it doesn’t. Bezos Expeditions is a financial investor of Arrived, along many others. But that does not make them the owner.

It definitely is. It provides transparency when it comes to fees, reporting, and liquidity. The company has a good plan for screening new investment properties.

OspreyFX offers TradeLocker.