Buy, trade, and hold 1,000++ financial instruments on AvaTrade

No Professional or Investment Advice. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation.

AvaTrade Review

AvaTrade was founded in 2006. It is one of the major operators of Forex and CFD markets represented in Australia, Africa, Asia, and Ireland. The broker is regulated under the most important financial regulators that help to build credibility among traders in its work.

AvaTrade Pros and Cons

- Regulated by Tier-1 regulations

- Provides different trading platforms

- Includes a risk management tool

- Over 1,000 trading instruments

- Allows for copy trading

- Has an Academy for research and learning

- High inactivity fees

Is AvaTrade Secure?

Yes, AvaTrade is secure. It is regulated by:

- The Central Bank of Ireland

- The Financial Conduct Authority

- The British Virgin Islands Financial Services Commission

- The Financial Services Agency

- The Polish Financial Supervision Authority

Markets and Products

AvaTrade offers more than 1200 Forex & CFDs on:

- Forex currency pairs

- Cryptocurrencies

- Bonds and treasuries

- ETFs

- Stocks

- Indices

- Shares

- Commodities (gold, silver, and crude oil)

AvaTrade Fees and Charges

You’ll need to deposit at least $100 to open an account. You’ll be charged fees that depend on the instruments you choose. Other fees include:

- Overnight premium fee

- An inactivity fee after 3 consecutive months of non-use (USD Account: $50, EUR Account: €50, and GBP Account: £50)

- Annual administration fee of $100 for the USD account, €100 EUR account, and £100 for the GBP account:

AvaTrade Account Types & Account Opening

AvaTrade has several trading accounts:

Live Account: Ava Trader’s prime account is designated as such; its markets are all open to trade; the spread starts at 0.9 pips on Forex; there’s an overnight attraction; it is available with AvaTrade platforms. Trade size on the account is from 1 micro lot, leverage up to 1:30 according to the Central Bank of Ireland, ASIC, FSCA; up to 1:25 according to the FFA and FFAJ; and up to 1:400 according to the BVI. Available tools include AvaProtect and Guardian Angel for risk management, while social trading is assured by AvaSocial among others, including very popular ones like ZuluTrade and DupliTrade.

Professional Account: This account is for professional traders who have demonstrated at least 12 months of consistent trading. It comes with a leverage of up to 400:1 on Forex pairs and 25:1 on certain Crypto-currencies. Reduced fixed spreads on forex are from 0.6 pips, and the trade size from 1 micro lot.

Islamic account: AvaTrade provides an Islamic account for all those customers who have the Islamic faith. Their markets include: Forex, commodities, shares, bonds, ETFs, and forex options, with a total over 1250 assets. Forex Spread starting from 0.9 pips No swap fee is charged. The trading size is from 1 micro lot. Leverage is capped at 1:30.

Spread Betting Account: In this account, the trader speculates on whether the market will go up or down. In return, the actual asset is never traded. Spreads are fixed from 0.9 pips in forex. Rollover fees are paid if the position is kept overnight. The minimum stake is £0.10 per point; the leverage is 1:30.

A Demo account: If you’re not sure whether you want to try the platform or not. This account mirrors the live trading, spread, and Islamic accounts.

How to Open an Account

To create an Avatrade account simply:

- Click on the “Register” button

- Enter your email and password.

- Click on “Create my Account”

- A pop-up will open with a registration form asking for personal details, financial details, trading experience & knowledge, as well as accepting the terms and conditions.

- Verify your account

To verify an account you need a colored copy of a valid government-issued ID (Passport, ID card, or Driver’s license) and proof of address not older than 6 months (Bank Statement/Credit Card Statement or Bank Details document, utility bill, Council tax bill, or internet bill)

Trading Platforms

AvaTrade provides access to different trading platforms. Each has features like automated trading, advanced charting, and other technical analysis tools.

- WebTrader: Offers web-based trading. It requires no download.

- AvaTrade App: Trading without the need to be in front of your pc. With the app you can trade on the go with internet connection.

- MetaTrader 4: One of the most popular ones. It offers automated trading.

- MetaTrader 5: Other than automated trading, it offers technical analysis tools and more order types.

- AvaSocial Mobile App: This app allows you to copy trades from the best traders.

Mac users can also trade using the MetaTrader4 Mac version, which has been optimized for the Mac interface. They can also use WebTrader.

AvaTrade Education Resources

AvaTrade provides various education resources through:

- Education tab: Here, you will find free educational resources and tutorials for all levels on trading, central banks, technical indicators, trading strategies, and technical analysis.

- AvaTrade Academy: The Academy has various free trading courses and trading guides.

Customer Service Overview

You can contact the customer service team using:

- Dedicated Client Services

- Whatsapp at +447520644093

- Live chat

AvaTrade Deposit and Withdrawals

There are several deposit and withdrawal methods. The processing times are quick, and there are no fees.

Deposit Methods

AvaTrade offers numerous deposit methods including all major credit cards, wire transfers, and e-payments like Skrill, Perfect Money, and Neteller. These methods depend on your location. The deposit page, on your account tab will show you all the available payment methods in your Country.

Withdrawal Methods

The withdrawal takes up to 2 working days. Any delays may be a result of delays from the banking institutions, payment systems or cards.

Withdrawals can only be sent via the payment methods used to fund your account

AvaTrade Online User Reviews and Ratings

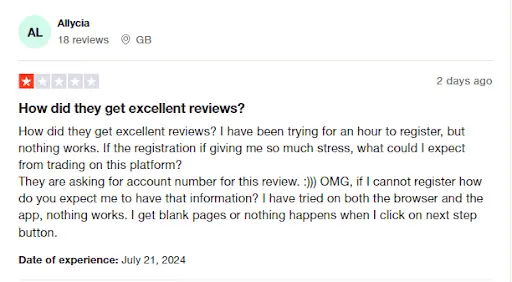

AvaTrade has excellent reviews on TrustPilot with a score of 4.5 out of 8,680 reviews.

75% of reviewers have given it 5 stars citing quick withdrawal and quick customer support.

14% have given it 1 star because of registration issues and withdrawal issues.

Author Opinion on AvaTrade

A great platform for traders of all skill levels. Its platform is user-friendly and quick withdrawals. It’s secure and regulated which is great. It gives access to many trading tools and instruments. The educational resources are something worth mentioning as well. In general, a great platform that got many awards for their work.

Frequently Asked QuestionsFAQ

Yes, you can trust AvaTrade. The platform is regulated by different top regulators.

The minimum deposit is $100.

Up to 2 days. Longer if there are any delays from your chosen withdrawal method.

There are several brokers that offer better features than AvaTrade like FP Markets

AvaTrade doesn’t charge a commission on trades.