Discover over 6900 Trading Possibilities at XTB

No Professional or Investment Advice. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation.

XTB Review

XTB was founded in 2004, in Poland. Initially, it was operating as X-trade brokers. Later in 2007, the company expanded to the Czech Republic, and opened branches in Slovakia, Spain, Romania, and Germany in 2008. As time went on, XTB ended up obtaining several licenses like DFSA, FCA, KNF, and CySEC.

An interesting thing to mention is that the Brand Ambassador of XTB is Zlatan Ibrahimovic. In general, XTB has over a million of investors, and it’s over 20 years on the market. Keep reading and see what else XTB brings to the table.

XTB Pros and Cons

- Regulated and secure broker

- Fast account opening

- A huge number of trading instruments available

- Good educational resources

- Inactivity fee

- Limited availability in some regions

- Only one trading platform available

Is XTB Secure?

XTB is licensed by CySEC, FCA, KNF, and DFSA which makes it a safe place to trade.

Markets and Products

XTB offers over 5800 trading instruments. It’s definitely a number bigger than many other competitors. You can trade:

The leverage depends on your location. In the UK/Europe, leverage is a maximum of 30:1. Non UK/EU residents have a leverage up to 500:1. MENA region residents can trade with leverage up to 30:1.

XTB Fees and Charges

Like most brokers, XTB charges an inactivity fee. If you’re inactive for more than a year, you’ll be charged $10 monthly.

For Standard accounts, CFD trades (excluding Equity CFDs and ETFs) have no commission but slightly wider spreads. Real stocks and ETFs are commission-free up to €100,000 per month (0.2% thereafter) with a 0.5% FX fee for non-base currency investments.

XTB Account Types & Account Opening

Looks like XTB offers only a Standard account type. The offerings are different for each region. Besides it, there’s also a Demo Account you can choose if you wish to first try the platform before choosing the real account.

How to Open an Account

Opening an account at XTB is easy:

- Click “Create account” on the website

- Fill in the form

- Then activate your account from the platform or Client office.

Trading Platforms

At XTB, you can only trade using the xStation 5 platform. Unlike many other brokers, XTB doesn’t offer cTrader, MT4/5 or NinjaTrader platforms.

Mobile Trading Platform

XTB offers a mobile app that 50% of their clients actively use. It’s equipped with features like Bulk order closing, Complete trade management and interactive charts with technical indicators. It’s suitable for Android and iOS devices.

XTB Research Tools

XTB offers tools integrated into the xStation 5 platform:

- Market Sentiment

- Top Movers

- Heatmap

- Economic Calendar

- Advanced Charting Tools

- Market News and Analysis

These tools enhance your trading strategy, and fit traders of all skill levels.

XTB Educational Content

When it comes to Educational content, XTB offers a comprehensive knowledge base. You can find pretty much anything there. Besides that, there’s also an eBooks option where you can find free reports and guides.

Customer Service Overview

You can reach out to XTB on their social media accounts or by phone or email depending on where you’re from. XTB supports over 15 countries.

XTB Deposit and Withdrawals

A pretty impressive thing is that XTB doesn’t require a minimum deposit amount. You can deposit as much money as you want. The depositing methods depend on the region you’re from:

UK – bank transfers, credit and debit cards

EU – bank transfers, credit and debit cards, PayPal and Skrill

MENA – bank transfers and debit cards

Non UK/EU – bank transfers, credit and debit cards, Skril,l and Neteller

Withdrawals and Payout Times

If you want to withdraw your funds:

- Click the Deposit-Withdrawal button in xStation and do the same after logging in to Client office

- Add your bank account and a photo of your bank statement

Withdrawal times, as well as fees depend on the region you’re from.

- UK Clients – No fees charged above £60, €80 or $100. Withdrawal takes up to one working day

- Clients with a CY account – No fees above €100. Withdrawals are done the following day

- Clients who have an International Limited account – No fee above $50 withdrawals. Processing time is one business day.

XTB Online User Reviews and Ratings

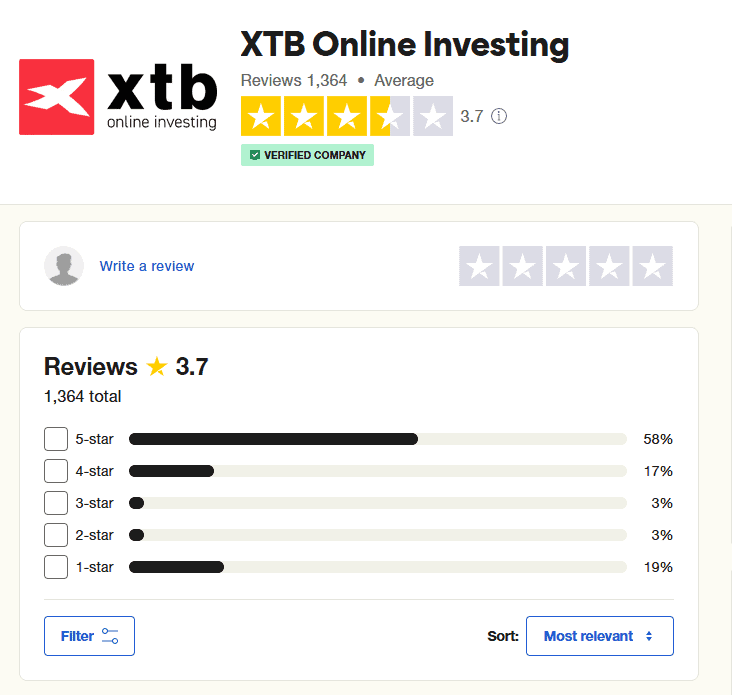

Users on Trustpilot have mixed feelings about XTB. There are over 1300 reviews, with 58% of them being 5-stars and 19% being 1-star reviews.

Some users love the platform, educational content, and low fees. But, some users claim that the prices are being manipulated and that the broker lost the quality it had before.

Author Opinion on XTB

The fact that XTB has existed for over 20 years says a lot about them. In comparison to other brokers, the number of trading instruments they offer is way higher than we usually see. Another great thing we don’t see often is that you don’t have to worry about minimum deposits. You deposit as much as you like. Being regulated by a few authorities is like a cherry on top. Trading with regulated and trusted brokers is a must if you don’t want to risk your funds.

However, a little downside are the trading platforms. Several very popular platforms among traders are not offered. Also, there could be more account options than one. This might change in the future hopefully. Generally speaking, this is a good broker that suits all types of traders.

FAQ

You can. It’s regulated by several authorities which makes it safe to trade on.

There’s no minimum deposit.

Withdrawal time depends on your region.