Bitcoin (BTC) has been in a bear market for almost two years. As a result, investors are eagerly waiting for the next rally of the leading cryptocurrency. During this period, various analyses and theories have emerged, speculating on the timing of the next Bitcoin surge.

Many external factors, such as regulatory uncertainty, continue to influence the asset. One of the notable theories comes from CryptoCon website, which drew insights from historical price movements to provide an understanding of what to expect in the future. The theory was shared on social network X (former Twitter) on September 7.

This BTC Bull Run theory predicts when the next Bitcoin bull run will begin

According to various sources, including CoinMarketCap and Cointelegraph, CryptoCon’s “November 28th Cycles Theory” has been a consistent predictor of Bitcoin’s price movements for a decade. The theory is based on the dates of the first two halvings, which occurred on November 28, 2012, and July 9, 2016. The analyst believes the theory holds the key to understanding Bitcoin’s price behavior over the years and suggests that BTC is likely to witness the start of a new bull run on November 28, 2024.

The Bitcoin November 28 Theory. Source: CryptoCon

According to the Satoshi Cycle theory, which established a cause and effect relationship between Bitcoin’s price and internet searches, Bitcoin’s price movements are cyclic, lasting approximately four years, and all centered around the date of the first Bitcoin halving event, which took place on November 28.

CryptoCon’s November 28th Cycles Theory predicts significant tops and bottoms in Bitcoin’s price occur roughly +/- 21 days from the date of November 28, with tops marking the upward momentum and bottoms signifying the pinnacle of a bearish trend.

CryptoCon predicts that the next Bitcoin bull run will start on November 28, 2024, with the next top in Bitcoin’s price expected to be around +/- 21 days from November 28, 2025, followed by the next bottom around the same time in 2026, and a subsequent mid-cycle lull is forecasted for June 2027. It’s important to note that cryptocurrency markets are highly volatile and influenced by a multitude of factors, making predictions inherently risky.

Bitcoin price analysis

The price of Bitcoin has minor gains in the last 24 hours, with gains of almost 2%, trading at $26,193 by press time. Over the past week, Bitcoin has gained less than 1%.

Despite the short-term gains, Bitcoin still trades below the $30,000 position, a crucial level for the next bull run.

Bitcoin Halving Is Nice, but Kickstarting Bull Run Requires More Fiat Money

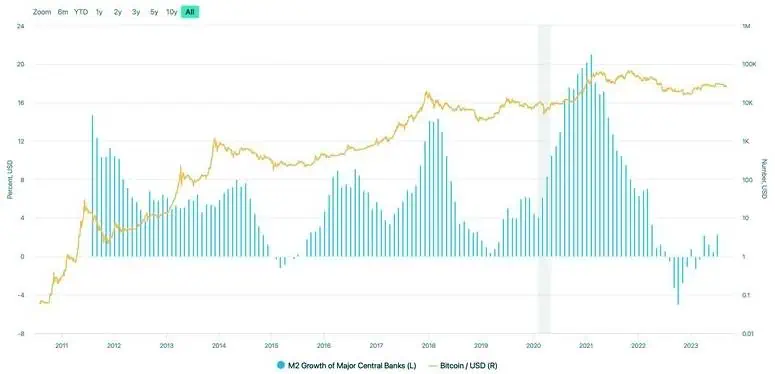

Investors hope that the upcoming Bitcoin halving event, set to occur in April 2024, will trigger a significant bull run. However, historical data suggests that previous halvings did not single-handedly catalyze bull runs, with major macroeconomic factors also playing a critical role. According to MacroMicro’s data, a significant uptrend in BTC’s price is likely contingent on major central banks boosting their year-on-year M2 money supply growth rates.

Bullish Reward Halvings?

Bitcoin’s reward halving is a pre-programmed event that reduces the pace of supply expansion by 50% every four years. The next halving, scheduled for April 2024, will reduce the per-block reward paid to miners from 6.25 BTC to 3.125 BTC.

Previous halvings occurred in November 2012, July 2016, and May 2020. Following each halving, Bitcoin experienced triple-digit price rallies to new record highs in the subsequent 12-18 months before entering significant downtrends. These bear markets ran out of steam roughly 15-16 months before the next halving.

In 2023, Bitcoin’s year-to-date gain of 56% has marked a recovery from the depths of the past year’s bear market and is consistent with the timing of previous price bottoms.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/SN3UID2WGZDRDERVGO22EL2TYE.png)

The M2 growth rate

According to data from CoinDesk and Yahoo Finance, any significant uptrend in Bitcoin’s price, expected after the next halving event in April 2024, is likely dependent on major central banks such as the U.S. Federal Reserve, European Central Bank, Bank of Japan, and People’s Bank of China boosting their year-on-year M2 money supply growth rates.

Historical data shows that macroeconomic factors such as abundant fiat liquidity conditions have played a significant role in driving BTC’s price rallies post-halving.

The aggregate M2 of these four major central banks represents the total value of their respective fiat currency circulating in the market.

Historical data shows that previous post-halving bull runs in Bitcoin were characterized by a 6% or higher aggregate M2 money supply growth rate of major central banks such as the Fed, ECB, BOJ, and PBOC. Conversely, bear markets coincided with a deceleration in the money supply growth rate.

This pattern validates the widely-held belief that Bitcoin is a “pure play” on fiat liquidity. However, while the total M2 money supply growth rate has turned positive this year, it remains well below the 6% mark. The Fed and most other central banks have raised rates rapidly over the past 12-18 months to tame inflation, and the probability of renewed liquidity easing in the months ahead appears low.

Source: https://www.coindesk.com/markets/2023/09/08/kickstarting-bitcoin-bull-run-requires-fiat-money-supply-growth/

What ChatGPT has to say about the Next Bitcoin Bull Run.

Artificial intelligence technology, such as ChatGPT, has become increasingly popular this year, enabling users to automate mundane tasks and streamline certain processes.

Chatbots like ChatGPT have also been used to discuss exciting topics that pique people’s interest, such as the cryptocurrency community’s current focus on the next bull cycle.

Given the prolonged bear market that has persisted for some time now, many are curious about when the next positive cycle will come.

Thus, we decided to check what ChatGPT has to say on the matter.

When Will Bitcoin Bull Run Happen According to AI?

As we have previously mentioned, ChatGPT does not provide direct predictions with specific timelines or deadlines. It can offer important hints and considerations that may assist in determining the potential timeline of the next bullish cycle.

Some of these factors include adoption and use cases, institutional investment, regulation, macro-economic factors, and technological developments. While each of these is crucial to analyze, some require a closer look. For instance, ChatGPT suggested that regulatory developments could significantly impact the cryptocurrency market. Favorable regulations can boost investor confidence, whereas unfavorable regulations can have the opposite effect.

There are currently multiple cases ongoing between the United States Securities and Exchange Commission and crypto-oriented companies like Ripple, with the lawsuit expected to have a considerable impact on the entire industry. On the topic of technological developments, adoption, and use cases, the past year has seen Bitcoin’s network grow significantly. Ordinals – the protocol that allowed BTC’s blockchain to be used for inscribing satoshis with images and other files, turning them into Bitcoin-native non-fungible tokens of a sort.

Bitcoin’s halving event is historically the most influential occurrence that defines market cycles for the entire cryptocurrency industry. This event happens roughly every four years and cuts the production of new BTC in half by reducing the reward miners receive for mining a block.

As a result, it has a massive impact on market dynamics. Basic economic principles suggest that if the demand for an asset appreciates or remains constant while its supply declines, its price should rise, which has been the case so far.

The next Bitcoin halving will likely occur in late Q1 or early Q2 of 2024, and traditionally, bull markets follow after. It remains to be seen whether history will repeat itself again.

Bitcoin all-time high in 2025? BTC price idea reveals ‘bull run launch’

It appears that there are various predictions for Bitcoin’s price in November 2024.

According to some sources, including experts in the industry, BTC’s value is expected to range from $29,226.61 to $130,000.

CryptoCon suggested that a mid-cycle lull will occur in late 2023 or early 2024, with a new bull run starting in late 2024. The “November 28th Cycles Theory” predicts that BTC’s all-time high will be reached in 2025.

It should be noted that cryptocurrency predictions should be taken as speculative and not a guarantee of future performance.

Countdown to BTC price “bull run launch”

There is ongoing debate around the nature of Bitcoin’s 4-year price cycle.

CryptoCon explains BTC/USD behavior may be simpler than many imagine when it comes to a given time. On X (formerly Twitter), he unveiled the “November 28th” chart and marked the date as a key pivot point in the year, along with a three-week period on either side.

CryptoCon explained that cycles are centered around the date of the first halving, which occurred on November 28th. Using four-year time cycles against his theory produces Bitcoin’s exact behavior in time since its inception.

“Bitcoin price action began at the first bottom October 8th, 2010. This is where cycle curves peak, every 4 years. Tops and bottoms come +/- 21 days from Nov 28th at their appropriate times on the curve. Tops on the upswing, bottoms on the pinnacle.”

The chart describes November 28 as the date Bitcoin sees a “bull run launch” every four years. The last was in 2020 when BTC/USD broke beyond its prior all-time high (ATH) to hit its current $69,000 record a year later.

The next point of interest is thus November 2024. Until then, BTC price action will spend its time in a “mid cycle lull.”

“After Bitcoin bottoms, price makes an early first cycle move (orange) and enters into a mid-cycle lull,”

“This is the longest part of the cycle, where Bitcoin spends time around the median price (half of previous ATH), until the curve bottoms.”

CryptoCon added that Bitcoin had “almost certainly” seen its early top, referencing the $31,800 local highs from July.

A Bitcoin “bull market fakeout”

Opinions on where BTC price will head into the 2024 block subsidy halving differ, with some predicting modest gains before the event.

Filbfilb, co-founder of trading suite DecenTrader, delivered a more bullish outlook with a $46,000 target for the halving and $35,000 for year-end.

In contrast, CryptoCon’s latest newsletter published on September 5th referred to 2023 BTC price behavior as a “bull market fakeout.” They stated that this makes it appear as if the bull market has begun with the trigger of many signals, but at some point, the price fails to continue growing.

“This is the most convincing example we’ve seen of this yet. Personally, I think there is still some time to go for that and I am patiently awaiting its completion.”

BTC/USD traded at $26,200 at the time of writing on Sept. 8, per data from Cointelegraph Markets Pro and TradingView.

Disclaimer: Investing can be quite a wild ride – especially when you don’t know the terrain! To keep things from getting too rocky, take some time beforehand to get familiar with all of the risks involved. Our site is here to up your investor game by providing all available intel about platforms and trends, but we don’t take responsibility nor can we be held accountable as advisors. That being said, it’s still important for you to make educated decisions that match what works best for YOU – just remember: no amount of savvy will guarantee success or protect against loss so invest money you can spare.